In this tutorial, we will explain how to use the new feature in MProfit that calculates the XIRR, considering cash inflows and outflows.

In the past, it only took into account PMS transactions, but now it also covers cash transactions.

Step 1: Login to your MProfit account and select the PMS portfolio for which you want to see the XIRR.

Then, navigate to the Analytics section.

Step 2: Click on Performance.

Here, you'll notice that the XIRR calculation now includes Cash In and Cash Out.

The screen shows the Cash In amount, Cash Out, Current Investment Value, and Cash on Hand.

At the top, there is a View Cashflows option.

Step 3: Click on View Cashflows to see detailed information about cash inflows and outflows.

Now, click View Summary to return back to the summary screen.

Here, you can see the Absolute Gain, Income Payout, and Total Fees.

Step 4: Click on See distribution to view a breakdown of the total fees.

The Cashflow Snapshot provides an overview of cash inflows and outflows.

On the right side, the XIRR is compared to the CAGR of various indices. This XIRR is calculated for all transactions in the portfolio to date.

Step 5: Click on All to Date to customize the time range.

Step 6: Select the desired time range, Financial Year, Calendar Year, Month, Trading, or Custom time range.

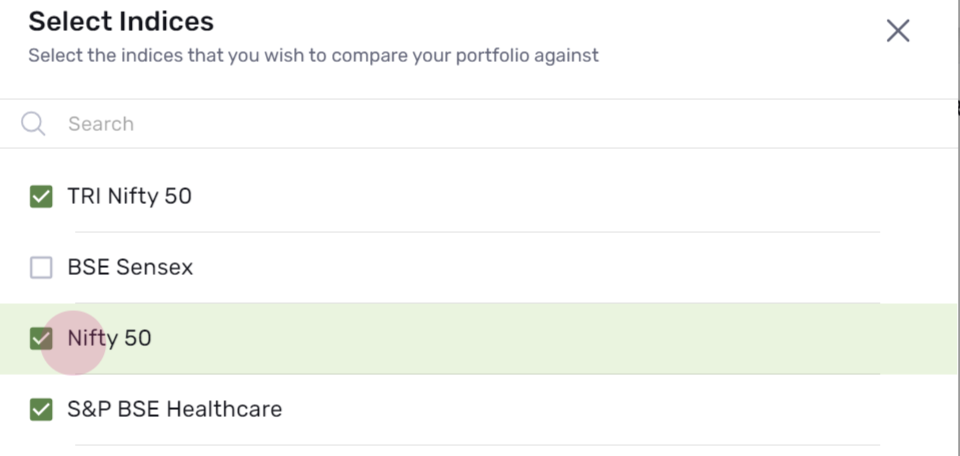

Step 7: Click on Change Indices to modify the indices for comparison.

Step 8: Make sure to unselect the undesired indices and choose the one you want.

Remember that you can select only five indices at a time.

Step 9: After selecting the indices, click Done.

This is how you can seamlessly use the new feature in MProfit that calculates the XIRR, considering cash inflows and outflows.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article